New research from RMLS shows that the percentage “distressed” property sales & listings in our local and regional market continues to dwindle, making up just a small portion of our sales. “Distressed” properties, often referred to as “foreclosures” (technically named REO or bank owned) and short sales (when debt on a property exceeds market value) were certainly a factor in the market a couple years ago. However, in the Portland metropolitan area, urban planning from years past and lack of sprawl have somewhat insulated our property owners from the total devastation that other over built markets experienced as a result of the housing meltdown.

With that said, we continue to hear rumors and rumblings of “the shadow inventory” (the stock piles of foreclosed properties that the banks might be sitting on). Does this shadow exist? Who knows??? But with barely 3 months of housing inventory and the voracious appetite of the buyers shopping the market, we feel pretty good about the stability of our market. At Inhabit, we coach our clients to play by the #1 rule of real estate: LOCATION, LOCATION, LOCATION! Purchasing property in the right location should keep you liquid and “in demand” in good markets and bad.

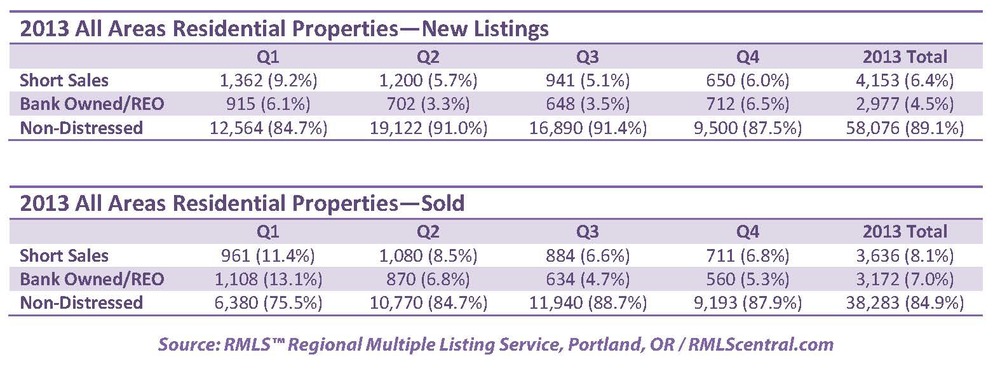

Portland metro when comparing percentage share of the market 2012 to 2013:

- Comparing ’12 to ’13, distressed sales as a percentage of closed sales decreased from 28.2% to 13.2%.

- New listings rose from 32,011 to 35,524 which is a 11.0% increase.

- Short sales comprised 6.4% of new listings and 8.0% of sold listings in 2013, down 5.7% and 4.3% from 2012 respectively as a percentage of the market.

- Bank owned/REO properties comprised 3.3% of new listings and 5.2% of sales in 2013, decreasing from 10.4% and 15.9% respectively in 2012.

Below is a chart showing the number of bank owned/REO and short sales in all areas of the RMLS system during 2013.

For more numbers and information, visit http://rmlscentral.com